Blog

The Different Types of Business Insurance

Insurance is necessary for businesses, big and small. However, the types of insurance your business may need will depend on […]

Recent

Does Car Insurance Cover Golf Cart Accidents in Arizona? A Guide for Residents and Snowbirds

Arizona, with its warm climate and numerous golf courses,...

March 19, 2024How Much Does Arizona Church Insurance Cost?

Churches and religious organizations play a vital role in...

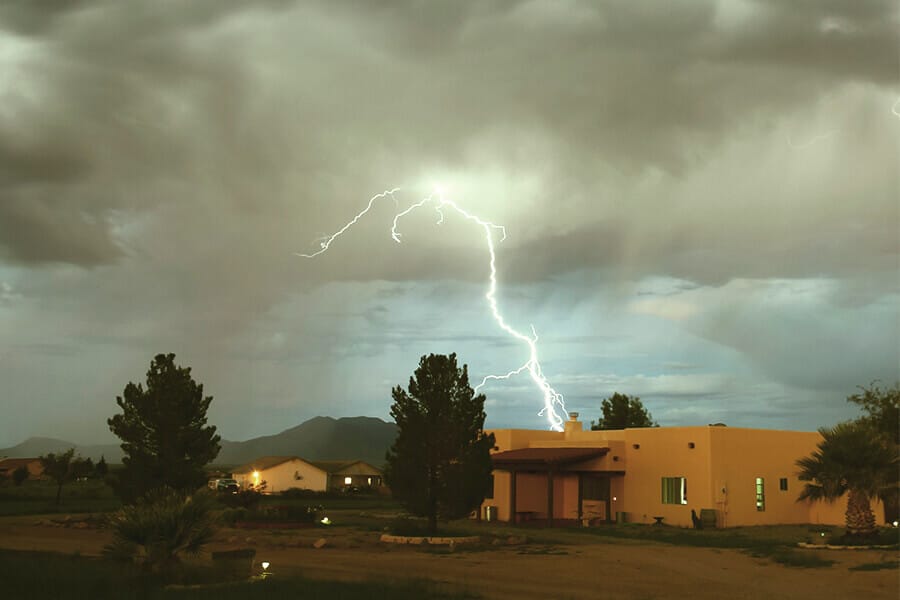

October 27, 2023Home Insurance

Auto Insurance, Business Insurance, Home Insurance

Auto Insurance, Business Insurance, Home InsuranceAnswering Your Questions: What is Commercial Insurance?

August 28, 2023Recent

Does Car Insurance Cover Golf Cart Accidents in Arizona? A Guide for Residents and Snowbirds

Arizona, with its warm climate and numerous golf courses,...

March 19, 2024How Much Does Arizona Church Insurance Cost?

Churches and religious organizations play a vital role in...

October 27, 2023 Insurance, Auto Insurance, Home Insurance, Life Insurance

Insurance, Auto Insurance, Home Insurance, Life InsuranceState Farm vs Progressive Insurance

April 27, 2023Stay in touch with us

And get a free quote!